does kansas have estate tax

In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

How Is Tax Liability Calculated Common Tax Questions Answered

The federal estate tax may still apply to Kansas residents even though the state does not have its own estate tax.

. Kansas began to phase out its estate tax in 2008 and completely eliminated the tax in 2010. Kansas has a property tax rate 140. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

It is the responsibility of the Kansas county appraiser to classify all taxable and exempt real and personal property. However if you are inheriting property from another state that state may have an estate tax that applies. The median home value in the state is slightly below the example above but at 139200 your property tax bill would still come out to about 1952 for the year.

In this detailed guide of the inheritance laws in the Sunflower State we break down intestate succession probate taxes what makes a will valid and more. The new process is based on the number of pages in the mortgage or deed filing and paid by buyers. With a property tax rate of 137compared to a national average of 107you stand to be hit with a hefty property tax bill every year.

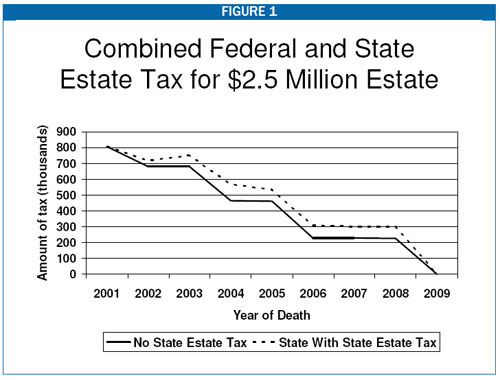

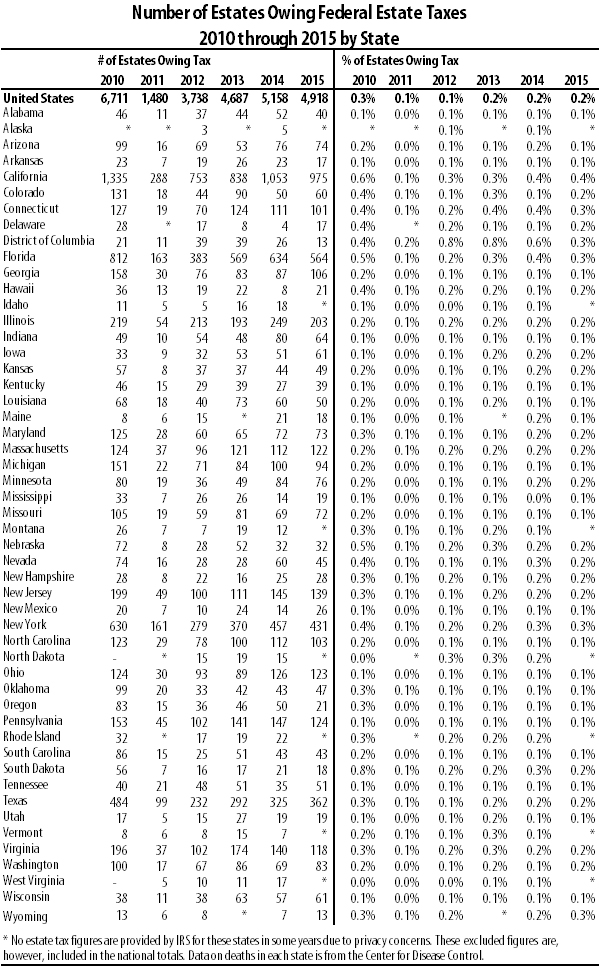

How are cars taxed in Kansas. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. In Kansas it is set at 026 for every 100 or 026.

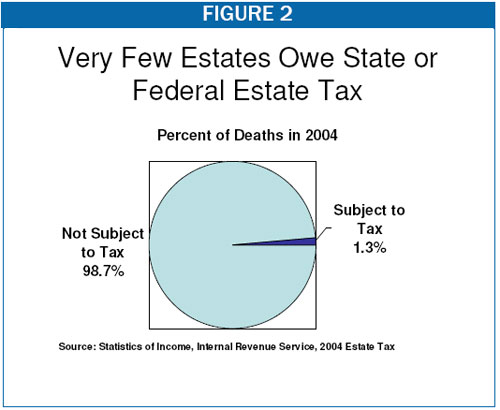

The federal estate tax applies to all estates in the United States of America that have a valued of slightly over eleven million dollars and are owned by a single person. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Kansas is one of the thirty-eight states that does not collect estate tax.

Under this section property subject to taxation is divided into two. Real estate transfer fees used to be complex in Kansas but have recently been reformed to make the process much simpler and easier to figure out. There are many costs and taxes you have to.

What is capital gains tax on real estate in Kansas. Counties in Kansas collect an average of 129 of a propertys assesed fair market value as property tax per year. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

If you want professional guidance for your estate plan SmartAssets free financial. Delaware repealed its tax as of January 1 2018. Kansas is ranked number twenty six out of the fifty states in order of the average amount of property taxes collected.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. Does kansas have inheritance tax. That means the annual tax on a 194000 home is 2713 per year.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Property is cheap in Kansas with an average house price of 159400 so your annual liability is at least kept to a median of 2235. Massachusetts and oregon have the lowest exemption levels at 1 million and connecticut has the highest exemption level at 71.

The median property tax in Kansas is 162500 per year for a home worth the median value of 12550000. Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. These surtaxes cumulatively raised approximately 24 million in 2008.

States including kansas do not have estate or inheritance taxes in place as of 2013. The state sales tax rate is 65. Kansas does not have an estate or inheritance tax.

Seven states have repealed their estate taxes since 2010. States That Have Repealed Their Estate Taxes. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

There are also local taxes up to 1 which will vary depending on region. Kansas is tough on homeowners. County taxes is 075 and city and township taxes are 225.

But this can vary greatly from area to area in Kansas. Kansas Sales Tax on Car Purchases. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees.

Capital gains in Kansas are taxed as regular income. Kansas Property Tax Exemptions. No city or township has a rate higher than 225 and 36 have a lower rate as low as 025.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. The federal estate tax exemption is 1170 million for deaths in 2021 and 1206 million for deaths in 2022. Kansas Real Estate Transfer Taxes.

In this detailed guide of. Does Kansas tax capital gains. 79-1459 Classification for the purposes of ad valorem taxation is delineated in Article 11 Section 1 of the Kansas Constitution.

However if you are inheriting property from another state. In most states it is set at a rate for every 500 of property value. Married Americans should know that the federal estate tax that applies to them is the tax on.

The surtaxes are generally uniform. As of 2013 estates in Kansas are not subject to a state-level estate tax.

Taxes On Your Inheritance In California Albertson Davidson Llp

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

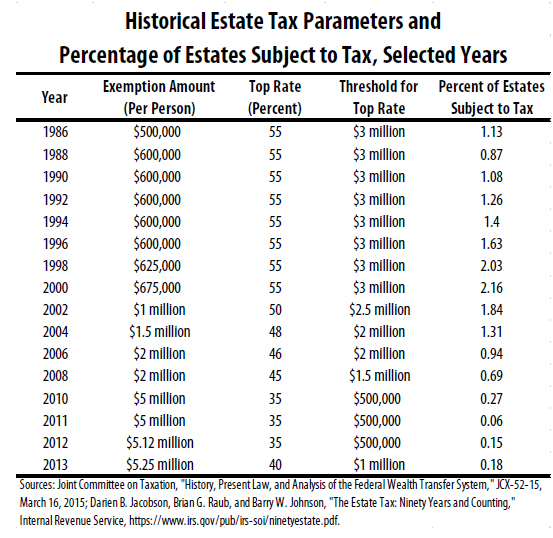

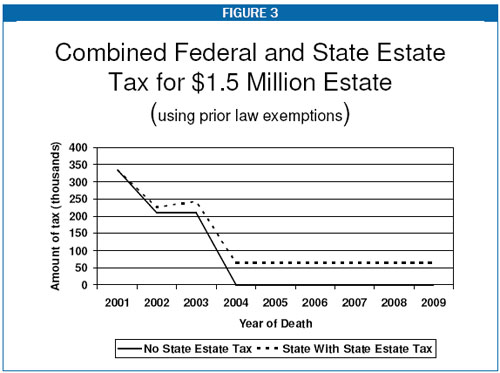

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Kiplinger Tax Map Retirement Tax Income Tax

New Stimulus Package May Be Introduced Next Week Estate Tax Types Of Trusts Senate

/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Grantor Trust Estate Planning Strategies To Implement Before The Biden Tax Proposals Take Effect Advicers Grantor Trust Estate Tax Estate Planning

Assessing The Impact Of State Estate Taxes Revised 12 19 06

States With No Estate Tax Or Inheritance Tax Plan Where You Die

1 Day Only Nice Downsizing Moving Estate Sale Starts On 8 30 2015 Platte Estate Sale City

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

9 Things You Should Know About The Tax Debate Itep

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Those Who Have A Better Grasp Of Tax Technicalities And Opportunities For Economic Growth Will Always View Estat Estate Planning Florida Real Estate Estate Tax

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep